Input Tax Credit Under Vat

Input Tax Credit Under The Punjab Value Added Tax Act 2005

“tax advantage” in relation to vat. 6 (1) a person (p) obtains a tax advantage in relation to vat if— (a) in any prescribed accounting period, the amount by which the output tax accounted for by p exceeds the input tax deducted by p is less than it would otherwise be;. As the old adage goes, taxes are a fact of life. and the more we know about them as adults the easier our finances become. there are many things to learn to become an expert (this is why we have accountants), but the essentials actually are.

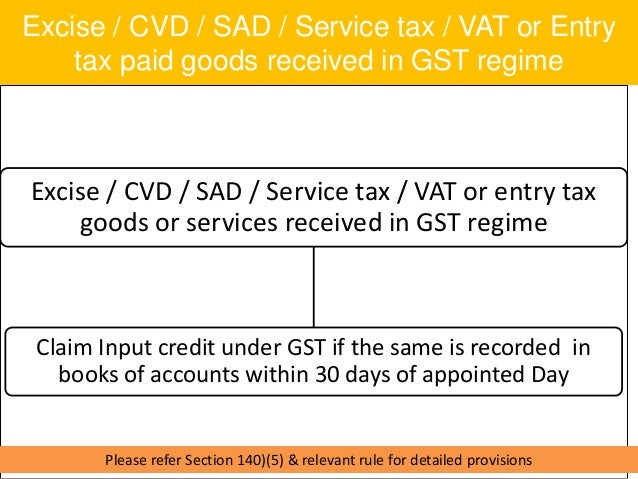

Input tax credit or set-off is the allowance of input tax against the tax payable on the sale and purchase of goods. net vat payable by a taxable person is equal to the output tax payable less available input tax credit. Input tax credit is the credit manufacturer's received for paying input taxes towards inputs used in the manufacture of products. similarly, a dealer is entitled to input tax credit if he has purchased goods for resale. all dealers are liable for output tax on taxable sales done in the process of his business. Input tax credit under vat: the value added tax (vat) is charged on the value addition to goods, with the vat liability being calculated on by reducing the input tax credit from the output sales tax during the payment duration. this can be explained with an input tax credit example: input purchased in the period: rs. 1 lakh. If the vat credits you receive from your suppliers exceed the vat you were charged on your purchases in any period, you will have a minus figure to enter in the input tax box (box 4) of your vat.

Vit11500 Vat Input Tax Hmrc Internal Manual Gov Uk

Value added tax (vat) is a type of consumer tax in europe. it is similar to sales tax in the united states; the tax is collected at the point of sale and forwarded to the government. there are certain circumstances where a business can redu.

Accounting For Input Tax Credit Under Gcc Vat

Vat taxes are added to almost everything you buy in greece, namely hotels, food, and souvenirs. however, you can get a refund if you know what to do. updated 06/03/19 travelers to greece may notice a vat tax added to their receipts. it can. Value added tax act: purchaser is permitted to avail input tax credit where seller has not paid output tax: judgments on june 29, 2020 june 30, 2020 by aji v. dev in indirect taxes vat availing input tax credit under the erstwhile state level value added tax laws prevailed in the indian states have subjected to much litigation all along. Mohan can claim input tax credit as purchase of goods for being used in execution of a works contract are eligible for input tax credit. purchases made by singla & co. from malhotra enterprises are not eligible for input tax credit as purchases from registered dealer who opts for composition scheme under the provisions of respective state vat act are not eligible for input tax input tax credit under vat credit.

A Brief On Input Tax Credit Of Vat Taxguru

What Is Output And Input Vat The Vat People

Child tax credits if you have children you support, there are two different tax credits you should know about. do you qualify for the adoption tax credit? if you're thinking of adopting, don't miss this generous tax credit. copyright © 2020. Government of nct of delhi & ors and as such, relating to the vat input tax credit under vat period the registered purchasers are eligible for input tax credit on purchases which are even not declared by the respective sellers in their returns on the strength of valid tax invoices.

The operation of the input tax mechanism is simple. the dealer will be eligible to take credit for the eligible input tax in a tax period as specified on the entire purchases. he will charge vat at the prescribed rate as is done in the present system for levy of sales tax. Businesses using the standard method may, in any given tax year, find that their actual deductible input tax differs significantly from that calculated based on the use of input tax in making taxable supplies. where this difference exceeds £50,000, or 50% of the residual input tax and £25,000, they must account for the difference between the 2 amounts by applying the standard method override.

For those who are selling goods in europe, it's critical to have an understanding of value-added tax. it isn't uncommon for those who are making sales to forgo the vat, and this is a mistake. here are some guidelines you should follow for h. In this case, his input tax credit will be restricted only to 80 per cent of rs. 125,000 or rs. 1,00,000. there is no need for a `one to one correlation between input tax credit and output tax. quite a number of small businesses are under the misconception that input tax has to be adjusted against output tax on a bill to bill basis. Credits reduce your federal income tax after your tax has already been calculated, which makes them a powerful tool for bringing down your tax bill. learn the difference between refundable and non-refundable taxes, and learn how to use them. Thus, input vat from suppliers normally accumulates and they could apply for vat refund or tax credit certificate within the two (2) year period. 2. excess input vat upon dissolution under section 112 (b) of the tax code another area for refund is upon retirement or cessation and quoted below:.

Input credits & vat deductions o'hanlon tax.

Accounting for input tax credit under gcc vat you are eligible to get input credit for the tax you have paid on your inward input tax credit under vat supplies (purchases). in case your inward supplies are reverse-chargeable, you are liable to pay tax, but you can claim input credit. The output vat is £30,000. on the vat return, output vat should be deducted from input vat, which in this case amounts to £17,600. if your vat on purchases exceed the vat on sales in any given period, the difference will be negative and refunded to you. Oct 25, 2011 · input tax credit or set-off is the allowance of input tax against the tax payable on the sale and purchase of goods. net vat payable by a taxable person is equal to the output tax payable less available input tax credit.

Increase input tax credit reversal of input tax refund of input tax credit increase input tax credit on imports 1. go to gateway of tally > accounting vouchers > f7: journal. 2. click j : stat adjustment. o select increasing input tax as the nature of adjustment. Learn what a vat tax is in the united states, its benefits and drawbacks, and how it compares to sales tax. a vat tax, or value added tax, is a taxing method that has been used throughout the world since the 1950s. the principle behind the. Jun 29, 2020 · government of nct of delhi & ors and as such, relating to the vat period the registered purchasers are eligible for input tax credit on purchases which are even not declared by the respective sellers in their returns on the strength of valid tax invoices. If vat is incurred wholly or partly for other purposes then it can only be input tax to the extent that it is incurred for business purposes. {ida4zx1h}entitlement to credit for input tax section.

Tax credits come with their own sets of rules, and qualifying can be tricky. but when you do, these tax breaks subtract directly from what you owe the irs. halfpoint images/getty images tax credits subtract directly from what you owe the ir. Input tax credits (itcs) can be used by canadian businesses to claim credits for any gst/hst paid on goods and services needed to do business. learn how to claim itcs. input tax credits (itcs) are credits that some canadian businesses can c.

Komentar

Posting Komentar